Are you having a 620 credit score and desiring to purchase a home? If so, the various inevitable tips covered in this write- up will certainly be vital to your needs. Basically, according to fact-finding, your credit score is among the important factors which will determine whether you will qualify for a home loan or not.

It is always essential you seek for the services of a professional financial adviser before you consider any kind of mortgage so that you can be given impeccable and dependable advice.

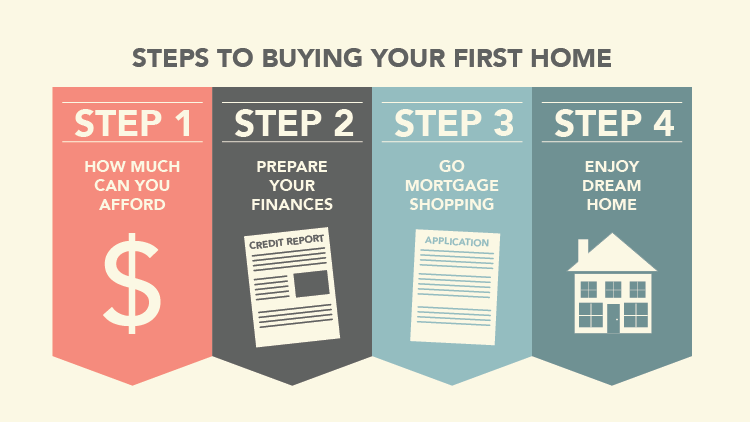

Buying a home with a 620 credit score is not only possible but can turn out to be a worthy investment. Here are the steps to put into consideration if you desire to buy a home with a 620 credit score:

STEP#1: CHECKING FOR ERRORS ON THE CREDIT REPORT

A person’s credit score is normally calculated from the credit data in his or her credit report. It is ideal you utilize your credit report when you want to know how you have used borrowed money. This will enable you to locate any errors if present, which could have the capacity of hurting your credit score.

In case you locate any errors in your credit report, consider the services of credit bureaus to sort them out.

STEP#2: BEING READY TO BE PAYING HIGHER INTEREST RATES

You can qualify for a loan with a 620 credit score if you are ready to be paying higher interest rates. According to research, most lenders will always charge credit- challenged borrowers an interest rate that is somewhat higher as a way of protecting themselves.

STEP#3: APPLYING FOR AN FHA MORTGAGE

Loans covered by the FHA i.e. Federal Housing Administration often have lower credit requirements. Generally, with a 620 credit score, you can be considered qualified for an FHA- covered mortgage if you can afford a down payment of approximately 3.5% of your property’s purchase price.

STEP#4: COMING UP WITH A HIGHER DOWN PAYMENT

The probability of lenders willing to give you an opportunity will be much high if you will have a higher down payment. Having a higher down payment will show lenders that you’re willing or ready to take on much of the risk in-house mortgage.

STEP#5: REBUILDING YOUR CREDIT

After you successfully acquire a home mortgage with a 620 credit score, it is appropriate you concentrate on rebuilding your credit score before you apply again for another loan in the future. Here are some of the reasons why you should consider the services of our firm i.e. Queen Credit Coach in an attempt to repair your credit,

WHY YOU SHOULD SEEK FOR OUR CREDIT REPAIR SERVICES

*You are Guaranteed of Flawless and Reliable Solutions

Our financial experts are well- trained and thus qualified. Therefore, be assured that your credit repair needs will be sorted by professionals that are not only competent once you seek for our solutions but very experienced as well.

*We Offer Online Credit Repair Solutions

You don’t require visiting where we are situated when you wish your credit needs to be handled by us. You can link with us via our website and be guaranteed that all your credit requirements will be dealt with in a safe and quick way.

*We are Affordable

In addition to offering impeccable credit repair services, we will offer you inexpensive prices so that you can afford and benefit from our firm.